Medicare Part A covers inpatient hospital care, and there are limitations on the number of days it will cover. For the first 60 days of hospitalization, there is no coinsurance cost, but for days 61-90, there is a daily coinsurance cost of $419. After 90 days, Medicare covers up to 60 additional lifetime reserve days, for which you will pay a daily coinsurance cost of $838. These days can only be used once in a person's lifetime and do not have to be used for the same hospital stay. Medicare Part A also covers up to 190 days of inpatient mental health care in a freestanding psychiatric hospital during a person's lifetime.

| Characteristics | Values |

|---|---|

| Medicare inpatient hospital services covered under | Part A (Hospital Insurance) |

| First 60 days of hospital stay | $0 after meeting Part A deductible ($1,676) |

| Days 61-90 of hospital stay | $419 per day |

| Days 91 and beyond | $838 per day for each lifetime reserve day (up to a maximum of 60 reserve days over a lifetime) |

| Days after lifetime reserve is used up | Full cost to be paid by the patient |

| Inpatient mental health care in a freestanding psychiatric hospital | Up to 190 days covered during a lifetime |

| Inpatient mental health care in a Medicare-certified psychiatric unit in a critical access or acute care hospital | No limit |

What You'll Learn

Medicare Part A covers the first 60 days of hospitalisation

Medicare Part A, also known as hospital insurance, covers inpatient hospital care. This includes a semi-private room, medications, nursing care, and other supplies and services needed for treatment. However, it is important to note that Medicare Part A only covers Medicare-approved hospital services and items, and there may be limitations on the number of days covered.

Medicare Part A covers the first 60 days of hospitalization after an individual has paid their deductible. During these first 60 days, there is no coinsurance cost, meaning the patient owes $0 out-of-pocket expenses. The deductible amount for Medicare Part A in 2025 is $1,676 for each benefit period. A benefit period begins on the first day of hospitalization and ends after 60 consecutive days without inpatient care.

If an individual needs to stay in the hospital beyond the first 60 days, they will be responsible for additional costs. From days 61 to 90 of hospitalization, there is a daily coinsurance cost. For days 91 and beyond, Medicare Part A offers "lifetime reserve days," which are limited to 60 days over an individual's lifetime. During these lifetime reserve days, the patient will owe a higher daily coinsurance amount.

It is important to note that Medicare Part A does not cover doctors' services received during hospitalization. These services fall under Medicare Part B, which covers 80% of Medicare-approved doctors' services. Additionally, Medicare Part A has specific coverage rules for inpatient mental health care in freestanding psychiatric hospitals, with a limit of 190 days of coverage during an individual's lifetime.

In summary, Medicare Part A provides coverage for the first 60 days of hospitalization, with additional coverage available for an extended stay, but it is important to understand the associated costs and limitations of this coverage.

Monitoring Contractions: Hospital Methods and Tools

You may want to see also

Days 61-90: $419 per day in coinsurance

Medicare Part A covers inpatient hospital care, including stays in various types of facilities. However, it is important to note that the coverage is dependent on the length of the hospital admission. If you are hospitalized for an extended period, you may need to pay attention to the coinsurance rates.

Coinsurance refers to the percentage of the Medicare-approved cost of your healthcare services that you are expected to pay after you have paid your plan deductibles. In the context of Medicare Part A, there are different coinsurance rates depending on the number of days you have been hospitalized.

For days 61 to 90 of your hospitalization, the coinsurance rate is $419 per day in 2025. This means that for each day you remain in the hospital during this period, you will be responsible for paying $419 towards the cost of your care. It is worth noting that this rate may change annually, so it is important to check the most current information.

If you have been hospitalized for an extended period and are facing these coinsurance charges, there are a few options to consider. One option is to utilize your lifetime reserve days if you have any remaining. Each individual is allotted 60 lifetime reserve days, which can be used after the first 90 days of hospitalization. During these reserve days, you will pay a coinsurance rate of $838 per day in 2025, with Medicare covering the remaining costs. However, once you have used up your 60 lifetime reserve days, you will be responsible for paying all costs yourself.

Another option to consider is purchasing supplemental coverage, such as a Medigap policy or prescription drug coverage (Part D). A Medigap policy can help cover your hospital coinsurance costs and provide additional inpatient coverage beyond your lifetime reserve days. Alternatively, if you have supplemental coverage from an employer, be sure to review the benefit details of your specific plan to understand what costs are covered.

Miscarriage Diagnosis: What Tests Do Hospitals Use?

You may want to see also

Lifetime reserve days: 60 days with a daily coinsurance of $838

Lifetime reserve days refer to the 60 days of additional coverage provided by Medicare Part A for inpatient hospital stays exceeding 90 days. These days can only be used once during an individual's lifetime and are intended to cover unforeseen circumstances requiring extended hospitalisation. Each lifetime reserve day incurs a coinsurance fee, which is the portion of the healthcare service cost that the patient pays after meeting their plan deductible. In 2024, this coinsurance rate was $816 per day, and it is expected to increase to $838 per day in 2025.

Coinsurance rates are typically based on a percentage of the Medicare-approved cost of healthcare services. For instance, if an individual's hospital stay extends beyond 90 days, they will enter their lifetime reserve days, and their coinsurance cost will be $838 per day. This means that for each day of hospitalisation beyond the initial 90 days, the patient will pay $838, and Medicare will cover the remaining cost.

The coinsurance fee for lifetime reserve days is separate from the Medicare Part A deductible, which is a set amount that must be paid before Medicare coverage begins. In 2024, the Medicare Part A deductible was $1,632 per benefit period. It is important to note that the coinsurance cost for days 1 through 60 is $0 after meeting the Part A deductible. From days 61 to 90, the coinsurance cost increases to $408 per day.

If an individual chooses not to use their lifetime reserve days, they must provide written notice to the hospital within 90 days of leaving. Additionally, Medigap policies can assist with coinsurance costs and provide up to 365 additional days of inpatient coverage beyond the 60 lifetime reserve days offered by Medicare. These policies vary, with some covering the full cost of the hospital deductible and others covering only a portion.

Understanding lifetime reserve days and the associated costs is crucial for individuals approaching or exceeding the 90-day inpatient hospital stay threshold. By carefully considering the costs and options, individuals can make informed decisions about their healthcare coverage and expenses.

Emergency Treatment: Drowning Incidents

You may want to see also

Inpatient psychiatric care: 190-day limit in a lifetime

Medicare Part A places a 190-day lifetime limit on inpatient psychiatric care in freestanding psychiatric hospitals. This limit does not apply to care received in a distinct part psychiatric unit within an acute care or critical access hospital. The 190-day cap on psychiatric care is problematic because it arbitrarily ends coverage, disrupting continuity of care and potentially worsening long-term outcomes for patients.

People with serious mental illnesses may easily exceed the 190-day limit, especially if they gain Medicare coverage at a younger age. Conditions like schizophrenia, bipolar disorder, and major depressive disorder often require ongoing treatment and multiple hospitalizations over a patient's lifetime. The 190-day limit can create barriers to care and lead to detrimental outcomes, such as ending up in hospital emergency rooms, in jail, or on the streets.

While federal parity laws have helped reduce discrimination by private insurance against people with mental illness, these protections do not extend to Medicare. Organizations like the National Alliance on Mental Illness (NAMI) and the National Association of Psychiatric Health Systems advocate for the elimination of the 190-day limit to achieve greater mental health parity and expand access to essential treatment for those with serious mental illnesses.

It is important to note that the 190-day limit does not include 60 lifetime reserve days that can be used for inpatient psychiatric care. Additionally, Medicare Advantage plans offer the same number of days as traditional Medicare, while Medicare supplements can buy extra lifetime reserve days. However, these options may not be accessible or affordable for everyone.

The 190-day limit on inpatient psychiatric care under Medicare Part A has been criticized as discriminatory and detrimental to individuals with mental illnesses. Removing this limit would improve parity in mental health coverage and ensure that those with serious mental health conditions have continued access to the specialized care they need.

Hospital Surveys: Effective or Just a Formality?

You may want to see also

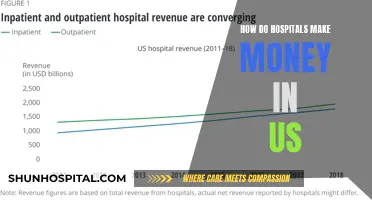

Medicare Advantage: caps annual out-of-pocket expenses

Medicare Advantage, also known as Part C, is a type of health insurance offered by private companies that contract with Medicare. These companies must meet the minimum requirements for coverage set by Medicare. Medicare Advantage plans have out-of-pocket maximums to protect their customers from high costs.

Every Medicare Advantage plan has an annual out-of-pocket maximum amount, which is a government rule. The Centers for Medicare and Medicaid Services (CMS) set a maximum out-of-pocket annual limit for these plans. The CMS maximum amount can change from year to year, and plans can set lower limits at their discretion, but they cannot be higher than the CMS maximum.

The average Medicare out-of-pocket maximum for Medicare Advantage plans in 2025 is $9,350 for in-network expenses and $13,300 for combined in-network and out-of-network expenses. However, some plans will have different limits on out-of-pocket costs for in-network and out-of-network expenses, so it is important to track these separately.

Once you reach the out-of-pocket threshold, you will not be financially responsible for costs such as deductibles, coinsurance, and copayments for covered services for the rest of the year. Your Medicare Advantage plan will then pay 100% of your costs for approved services.

It is important to note that Medicare Advantage plans have some out-of-pocket costs in addition to monthly premiums. You will be responsible for an annual deductible and cost-sharing for services. Some plans may have no deductible, but these plans will likely cost more in monthly premiums.

Incorporating a Hospital: Steps to Success

You may want to see also

Frequently asked questions

No, Medicare does not limit hospital stays to 100 days. Medicare covers the first 60 days of a hospital stay after a deductible is paid. For days 61-90, a daily coinsurance cost applies. After day 90, Medicare covers up to 60 additional lifetime reserve days, for which a daily coinsurance must be paid.

For the first 60 days of a hospital stay, Medicare Part A covers the full cost of $0 coinsurance after the deductible is paid.

For days 61-90 of a hospital stay, Medicare Part A covers the cost of $419 per day in coinsurance.

For days 91 and beyond, Medicare covers up to 60 lifetime reserve days, for which a daily coinsurance of $838 must be paid.