When it comes to healthcare, insurance plays a crucial role in ensuring that individuals can access the medical services they need without facing financial barriers. In the United States, the topic of insurance and healthcare is often a complex one, with many individuals unsure of how their insurance works and what their plan covers. This lack of clarity can lead to unexpected costs and financial burdens, especially when it comes to hospital visits. It is important to understand how hospitals determine a patient's insurance status and how this impacts the care they receive. This knowledge can help individuals navigate the healthcare system more confidently and ensure they are not faced with unexpected bills.

| Characteristics | Values |

|---|---|

| Hospitals must treat patients regardless of insurance status | Yes, but patients are responsible for the full cost of the visit |

| Protection from unexpected out-of-network charges | Yes, in most cases |

| Good faith estimate | Yes, if care is scheduled at least 3 business days in advance or if asked for |

| Billing dispute | Yes, if the bill is at least $400 more than the estimate |

| Time limit on billing dispute | 120 days from the initial bill |

| Negotiating bills | Yes, hospitals may grant discounts or allow patients to pay negotiated amounts over time |

| Financial assistance | Yes, hospitals may offer financial assistance programs, sometimes called "charity care" |

| Urgent care alternative | Yes, urgent care centers offer lower costs than ERs |

| Free clinics | Yes, free clinics provide essential health services at no cost |

| Medicaid | Yes, Medicaid provides comprehensive coverage for those who qualify |

What You'll Learn

Hospitals ask for insurance information

In the United States, the Emergency Medical Treatment and Active Labor Act (EMTALA) ensures that anyone coming to an emergency department is stabilized and treated regardless of their insurance status or ability to pay. This means that if you are experiencing a medical emergency, you will receive treatment even if you do not have insurance. However, EMTALA does not cover the subsequent medical bills, so uninsured patients are often responsible for the full cost of their care.

If you are uninsured and facing high medical bills, there are several options available to you. You may be able to negotiate your hospital bills, seek financial assistance, or receive discounts from hospitals and doctors. You can also look into government programs, such as Medicaid, that can provide coverage for those who qualify. Additionally, free clinics provide essential health services at no cost, and urgent care centers offer lower-cost alternatives to emergency rooms for non-emergency situations.

It is important to understand your rights and options when it comes to health insurance and medical care. If you are unsure about what your insurance plan covers, contact your insurance company or health plan provider. If you are uninsured, you can research and apply for insurance alternatives to protect yourself from the financial burden of unexpected medical costs.

Selling Medical Devices: Navigating the Hospital Procurement Maze

You may want to see also

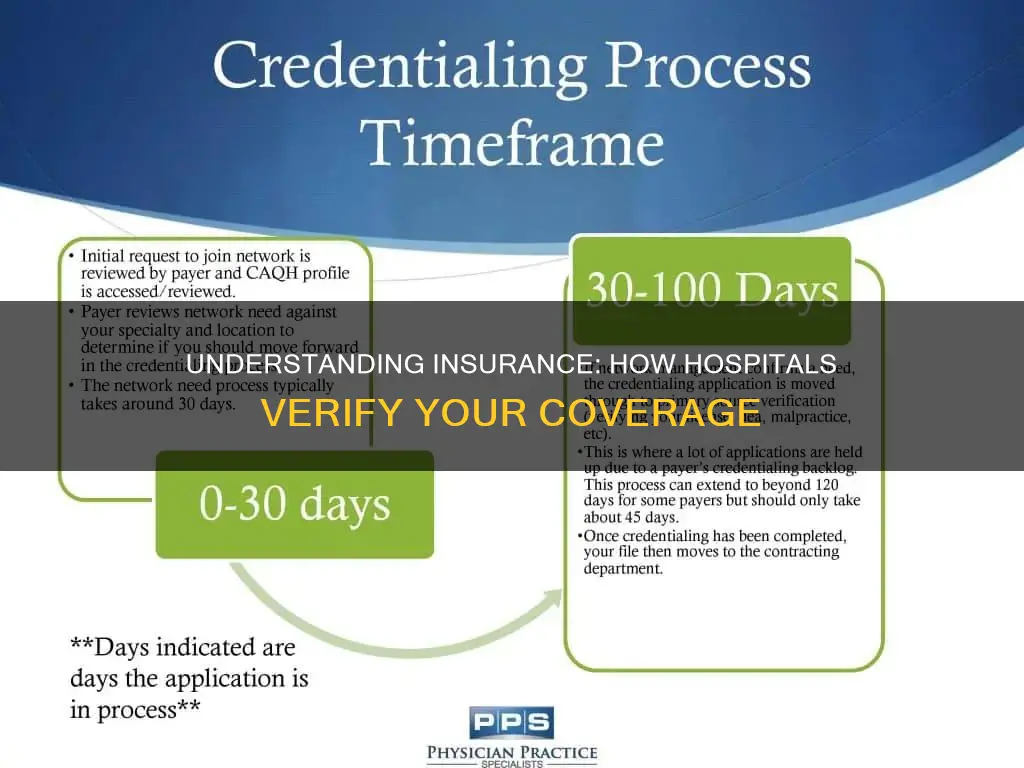

Doctors and hospitals are part of an insurance company's network

Each insurance company has different rules for using healthcare benefits, and most plans require patients to receive their care from certain doctors and hospitals. These in-network providers are listed on the insurance company's website, and individuals can also call the insurance company to find out which doctors and hospitals are in their network.

It is important to note that while insurance companies prefer that their customers use in-network providers, there is some flexibility in going out-of-network. However, this may result in the insurance company covering less of the cost of care.

In-network providers are those doctors, hospitals, and healthcare providers who have contracted with a particular health care plan to provide services for its members. These providers negotiate prices with the insurance company, agreeing to charge a certain amount of money for different medical procedures. For example, an insurance company may agree to pay a certain amount to a pediatrician for every check-up performed for patients covered by the insurance plan.

Overall, the relationship between doctors, hospitals, and insurance companies is a complex one, with negotiated contracts and pricing playing a significant role in determining which providers are considered in-network.

Compliance Programs: Reducing Denials, Improving Hospital Performance

You may want to see also

Patients may be seen by out-of-network providers

When seeking medical care, it's essential to understand the distinction between "in-network" and "out-of-network" providers in relation to your health insurance plan. An in-network provider has a contractual agreement with your health plan, accepting negotiated rates for their services. This typically results in lower out-of-pocket costs for patients. On the other hand, an out-of-network provider does not have a contract with your health insurance plan and hasn't agreed to accept the negotiated rates, often leading to higher costs for patients.

In certain situations, patients may inadvertently or unavoidably receive treatment from out-of-network providers. This can occur when your local hospital is in-network, but some of the doctors or specialists treating you are not part of your insurance network. This variation depends on the hospital's business practices and the preferences of the insurance company. For instance, an insurer may opt to keep their network small to maintain stronger negotiating power with providers.

The No Surprises Act protects patients from receiving unexpected balance bills from out-of-network providers when treated at an in-network hospital. This means that if an out-of-network anesthesiologist assists with your surgery at an in-network hospital, you won't be charged unexpected out-of-network fees. However, this protection doesn't apply to vision-only and dental-only insurance plans unless they include specific benefits.

In emergency situations, the Affordable Care Act (ACA) mandates that insurers cover emergency care as if it were provided in-network, regardless of whether the care is obtained at an in-network or out-of-network facility. This protection extends to most cases of emergency room visits, shielding patients from unexpected out-of-network charges for emergency medical services. However, ground ambulance services are generally not covered by the No Surprises Act and may result in out-of-network rates.

It's important to note that even if your insurance company treats out-of-network care as in-network due to special circumstances, the out-of-network provider is not federally mandated to accept the insurance company's payment as full payment. Therefore, it is advisable to carefully review any notice and consent forms presented by out-of-network providers, as signing them may result in giving up your billing protections.

Joe DiMaggio Children's Hospital: Its Founding and Legacy

You may want to see also

Hospitals have no obligation to check insurance status

Hospitals have no obligation to check a patient's insurance status. In fact, it is illegal for a receiving hospital to ask about a patient's insurance status before accepting or rejecting a transfer, if the transfer is an "EMTALA" transfer. EMTALA no longer applies, according to CMS, so a receiving hospital has no legal obligation to accept a patient's transfer under EMTALA. However, there are times when a receiving facility may ask for insurance information before accepting a patient, and they probably should if they want to be compensated for their services. For example, if the patient does not have an EMC or has been admitted, the hospital can demand to know the patient's insurance status and decide whether to accept or reject the transfer based on the insurance information.

While hospitals are not obliged to check a patient's insurance status, it is practical for them to know this information for prescribing medications or arranging follow-up appointments for discharged patients. Additionally, when a patient is being transferred, the sending hospital should be aware of which receiving hospitals are capable of providing the needed emergency care, whether that is burn care, neurosurgery, neonatal intensive care, or any other specialty service.

Healthcare providers are not allowed to ask patients to sign a notice and consent form when they are providing items and services related to emergency medicine. However, an out-of-network provider may ask patients to sign a notice and consent form after an emergency room visit. By doing so, patients give up their billing protections.

Patients have certain protections under the No Surprises Act. For example, when patients go to the emergency room, they are usually protected from unexpected out-of-network charges for emergency medical services. If their health insurance covers emergency care, they cannot be charged more for emergency medical services than the in-network "cost-sharing" rate. However, some health plans do not cover emergency care, so patients should check with their insurance company or health plan.

Pregnancy Testing Methods: Hospital Procedures Explained

You may want to see also

Insurance coverage varies by doctor, specialist, and clinic

When you go for medical care, you will provide your insurance information to the doctor or hospital. They will then bill your insurance company for the services you receive. Doctors and hospitals often contract with insurance companies to become part of the company's "network". The contracts outline what they will be paid for the care they provide. If you go to a doctor in your insurance company's network, you will pay less out of your own pocket than if you go to a doctor who doesn't have a contract with your insurance company.

Different plans cover different doctors, specialists, and clinics, so it's important to make sure that the doctor you want to see is covered. You can call your insurance company using the number on your insurance card, and they will tell you the doctors and hospitals in your area that are part of their network. You can also find this information on the insurance company's website.

Preventive services are usually covered by health insurance, but only when you receive care from a doctor or clinic in your network. Preventive care includes yearly exams, immunizations, health screenings, and other steps you take to stay healthy. Most insurance carriers have price transparency tools that can help you estimate what you'll pay out of pocket, both for in- and out-of-network care. It's a good idea to check, as providers in the same network can charge different rates for the same services or prescription drugs.

Preferred provider organization (PPO) plans offer coverage through a specific network of doctors, clinicians, and specialists. Most PPO plans allow you to see providers both in and out of the network, but you pay less out of pocket when going to in-network doctors. Health maintenance organization (HMO) plans limit coverage to healthcare services provided by doctors who are in your network, which are often specific to the area you live or work in. These plans typically don’t cover out-of-network services outside of emergencies.

The Impact of Straw Bans on Hospitals

You may want to see also

Frequently asked questions

When you go for care, you will give your insurance information to the hospital. Doctors usually make a copy of your insurance card the first time they see you as a patient.

If you go to a hospital that is out of your insurance company's network, you might have to pay a bigger part of the bill or perhaps the whole bill. If you have an emergency, you’re protected from unexpected out-of-network charges (“surprise bills”) for emergency medical services in most cases.

You can call your insurance company using the number on your insurance card. The company will tell you the hospitals in your area that are part of their network. You can also find this information on the insurance company's website.