Student loan repayment assistance is an increasingly common benefit offered by hospitals and healthcare employers to attract and retain highly skilled staff. In a competitive job market, hospitals are incentivizing new and soon-to-be physicians with student loan repayment bonuses, often in exchange for a commitment to stay in the community for a given period. This benefit can be structured in various ways, including direct repayment, discretionary benefit funds, or matching 401(k) contributions. Healthcare employers may offer loan repayment assistance to all employees or only full-time workers, with eligibility criteria such as employment duration or graduation date. Loan repayment programs are also offered through the government, such as the NHSC Loan Repayment Program, where licensed primary care clinicians can receive loan repayment assistance in exchange for serving in a Health Professional Shortage Area (HPSA).

| Characteristics | Values |

|---|---|

| Who is eligible? | Healthcare employers may choose to provide student loan repayment assistance to all employees or only full-time workers. Employees may also have to meet individual criteria for being "benefits-eligible", including being employed for a specified period (e.g., six months) or having graduated within a certain timeframe (e.g., the last 10 years). |

| Contribution amount | Employers may pay different contribution amounts to full-time and part-time employees. They may also limit how much they contribute during an employee's tenure, with a cap that varies depending on contribution amount and employee eligibility. |

| Payment structure | Employers can set up recurring payments, matching payments, or a lump sum (e.g., a signing bonus). They can also provide discretionary funds that employees can use for benefits like an HSA, 401(k), or student loans. |

| Government programs | The Public Service Loan Forgiveness program requires 10 years of employment with a government or non-profit organization and 120 income-driven monthly payments. After 10 years, the remaining loan is forgiven. |

| NHSC Loan Repayment Program | Licensed primary care clinicians can receive loan repayment assistance. Full-time service providers can receive up to $75,000 for a two-year initial term, while half-time service providers can receive up to $37,500. |

| Average student loan debt | The average medical student graduates with nearly $200,000 in student loan debt, with 84% of medical students and 90% of other health sciences students graduating with debt. |

What You'll Learn

Loan repayment programs

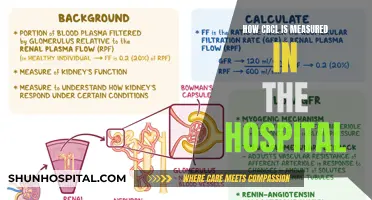

There are two main types of loan repayment assistance: direct repayment and loan forgiveness. With direct repayment, the hospital or employer sends contributions directly to the employee's student loan servicer. This can be structured in various ways, including recurring payments, matching payments, or a lump sum. Employers may also choose to provide discretionary funds that employees can put toward their student loans. On the other hand, loan forgiveness programs eliminate all or part of the remaining debt after a set period of qualifying repayments.

Eligibility for loan repayment assistance may depend on factors such as employment status (full-time or part-time), length of employment, and graduation date. Healthcare employers should consider both the average monthly debt payment their employees may owe and their budget when determining contribution amounts. They may also set a lifetime cap on the total contribution amount.

In addition to employer-provided loan repayment assistance, licensed primary care clinicians can explore loan repayment programs such as the NHSC Loan Repayment Program. This program offers up to $75,000 for primary care providers and $50,000 for all other providers serving full-time in Health Professional Shortage Areas (HPSAs). Participants receive funds to repay their outstanding qualifying school loans, and the funds are exempt from federal income and employment taxes.

Staph Aureus: A Common Hospital Superbug?

You may want to see also

Employer-sponsored incentives

Student loan repayment incentives are funded by the hospital or practice. The bonus is designated for loan repayment only. The employer may request the employee's loan documents and make payments directly to the loan servicer, or they may reimburse the employee for payments made. Employers may choose to set up recurring payments, matching payments, or a lump sum.

There are many other ways to implement a student loan benefit. For example, employers may provide discretionary funds that employees can put toward their student loans. Alternatively, healthcare employers may offer matching 401(k) contributions when an employee directs part of their check toward student loan payments.

In a competitive job market, employers are offering incentives to attract candidates, such as signing bonuses or commencement bonuses. According to a 2023 report by AMN Healthcare's Physicians Solutions division, 63% of searches in 2022-2023 featured bonuses, down from 92% in 2021-2022. By contrast, only 18% of searches tracked in the report featured loan repayment.

Loan repayment incentives can be particularly appealing to new residents, who typically earn less than $60k per year and may struggle to meet minimum loan payments. For example, Dr. Benz received a $100,000 loan repayment stipend on top of a signing bonus, which she found very appealing.

Some employers may require employees to meet certain criteria to be eligible for loan repayment assistance, such as being employed for a specified period (e.g., six months) or having graduated within a certain timeframe (e.g., the last 10 years). Employers may also choose to provide loan repayment assistance to all employees or only full-time workers, and they may pay different contribution amounts to full-time and part-time employees.

Sending Flowers to a Hospital: A Step-by-Step Guide

You may want to see also

Student loan forgiveness

There are also student loan forgiveness programs offered by the government. For example, the National Health Service Corps (NHSC) Loan Repayment Program offers licensed primary care clinicians funds to repay their outstanding school loans in exchange for serving at least two years at an NHSC-approved site in a Health Professional Shortage Area (HPSA). The Bureau of Health Workforce also offers eight loan repayment programs that repay part of school loan debt in exchange for serving in an eligible healthcare facility for a community in need.

Additionally, there are federal student loan forgiveness and income-driven repayment plans, such as the Income-Contingent Repayment (ICR), Pay-As-You-Earn (PAYE), and Saving on a Valuable Education (SAVE) plans. However, recent legislation passed by Republican lawmakers in the House of Representatives includes plans to repeal several key federal student loan forgiveness and repayment programs, which could impact these income-driven repayment plans and tax relief on student loan forgiveness.

Student loan debt is a significant burden for many healthcare professionals, and student loan repayment benefits and forgiveness programs can provide much-needed financial relief, helping them overcome financial barriers and thrive in their careers.

Hospitals Under Siege: Ransomware Attacks and Data Security

You may want to see also

Direct repayment

There are several ways in which direct repayment can be structured. Employers may opt for recurring payments, matching payments, or a lump sum payment, often referred to as a signing bonus. In the case of a signing bonus, the hospital or practice provides a monetary incentive to attract candidates, which can be used at the employee's discretion for expenses such as housing, loan repayment, or investment. This bonus may be paid upfront and forgiven incrementally over several years of employment or paid in instalments. It is important for employees to consider the overall compensation package, including salary and bonuses, when evaluating job offers with loan repayment support.

Healthcare employers have the flexibility to determine the eligibility criteria for receiving direct repayment assistance. They may choose to offer this benefit to all employees or solely to full-time workers. Additionally, employees may need to meet specific criteria, such as being employed for a minimum period or having graduated within a certain timeframe. Employers also have the discretion to set contribution amounts, which may vary between full-time and part-time employees, and they can establish a lifetime cap on the total contribution amount.

Hospital Care in Boise: How Does It Rank?

You may want to see also

Eligibility criteria

The eligibility criteria for student loan repayment hospital bonuses vary depending on the healthcare employer and the government program. Here are some common eligibility criteria:

Healthcare Employer Criteria:

- Employee status: Some employers may offer loan repayment assistance to all employees, while others may restrict it to full-time workers only.

- Employment duration: Employees may be required to have worked for a specified period, such as three months, six months, or a year, to become eligible for loan repayment benefits.

- Graduation timeframe: Employers may require employees to have graduated within a certain timeframe, such as the last 10 years.

- Contribution limits: Healthcare employers may set a cap on the total amount they will contribute to an employee's student loan repayment during their tenure. The cap may vary depending on the contribution amount and employee eligibility.

- Payment structure: Employers may choose to make recurring payments, matching payments, or a lump sum bonus towards an employee's student loan. They may also allow employees to use discretionary benefit funds for loan repayment.

Government Program Criteria:

- Citizenship: Some government programs, such as the NHSC Loan Repayment Program, require applicants to be citizens or nationals of the United States.

- Discipline and licensure: Applicants must be trained and licensed to practice in an eligible discipline and state. Eligible disciplines may include primary care, dental care, mental/behavioral health care, and maternity care.

- Service obligation: Applicants may need to commit to serving in a Health Professional Shortage Area (HPSA) or a specific community in need for a certain period, such as two years.

- Loan type: The loan repayment programs are typically for outstanding, qualifying school loans. Applicants may need to verify that they will use the funds to repay eligible school loans.

- Tax status: In some cases, the loan repayment funds received through government programs may be exempt from federal income and employment taxes.

Man's Best Friend: Healing Hospital Patients

You may want to see also

Frequently asked questions

Hospitals or healthcare employers may offer to pay off a certain amount of student loan debt to attract and retain highly skilled staff. This is usually in exchange for a commitment to stay at the hospital for a given period.

Employers can set up recurring payments, matching payments, or a lump sum. They may also allow employees to use discretionary benefit funds to pay their student loans.

Employers may choose to offer loan repayment to all employees or only full-time workers. Employees may also have to meet certain criteria, such as being employed for a specified period or having graduated within a certain timeframe.

Yes, there are loan repayment programs through the Office of Healthcare Workforce Development and the NHSC Loan Repayment Program. These programs offer financial support to health professionals who agree to provide direct patient care in medically underserved areas.