Denmark has a mixed public-private healthcare system, with the public sector being the largest purchaser of healthcare products and services. Healthcare in Denmark is largely provided by the local governments of five regions, with some specialised hospital services managed centrally. The country has seen a decline in general acute care hospitals, with the sector undergoing modernisation and restructuring. Denmark is set to build 16 new hospitals, including 8 super hospitals, with a budget of USD 7 billion. This has resulted in excellent opportunities for companies in the construction of new hospital buildings and the medical technology sector, which is growing at a rate of 4-6% per year.

What You'll Learn

Advertising through trade shows and events

When it comes to the healthcare industry in Denmark, there are several trade shows and events that are relevant for advertising new hospitals. One notable example is the annual SCANDEFA trade show in Copenhagen, which is specifically targeted towards dentists and dental professionals. This trade show provides an opportunity for dentists to purchase inventory and connect with suppliers and distributors. Additionally, there are various trade fairs and conferences in Denmark related to the medical and pharmaceutical industries, as listed on websites like 10times.com. These events can be excellent platforms for advertising new hospitals by showcasing their services, expertise, and innovative technologies.

Furthermore, Denmark has a strong focus on medical technology and digital health solutions. The country is a frontrunner in medical device innovation, with significant investments in research and development. As such, trade shows and events related to medical technology and HealthIT can be strategic platforms for advertising new hospitals. These events attract global patients and healthcare providers who are interested in the latest advancements and innovations in the industry. By participating in these events, new hospitals can highlight their adoption of cutting-edge technologies and establish themselves as leaders in the field.

Additionally, with Denmark's emphasis on preventive care and health promotion, trade shows and events focused on wellness, health, and fitness can also be effective advertising channels for new hospitals. By sponsoring or exhibiting at these events, hospitals can showcase their commitment to preventive care and connect with potential patients who are proactive about their health and well-being. It is worth noting that the rules and regulations for advertising and marketing in Denmark are outlined in the "Markedsforingsloven" (the Marketing Practices Act), and compliance is overseen by the Consumer Ombudsman.

Overall, advertising through trade shows and events in Denmark can be a powerful strategy for new hospitals. By participating in industry-relevant events, hospitals can reach their target audiences, showcase their services and technologies, and establish themselves as leaders in the healthcare sector. However, it is important to be mindful of the country's advertising regulations and cultural nuances to ensure a successful and compliant advertising campaign.

Preparing for the Unthinkable: Hospitals and Active Shooters

You may want to see also

Online advertising and digital presence

Denmark has one of the most digitalised health systems in the world, with IT being used at all levels of the healthcare system. Each of the five administrative regions uses electronic health record (EHR) systems for hospitals, with adherence to national standards for compatibility. All citizens in Denmark have a unique electronic personal identifier that is used in all public registries, including health databases. The government has implemented an electronic medical card that stores encoded information about each patient's prescriptions and medication use, which can be accessed by the patient and all relevant health professionals. This system also enables patients to access their medical records online.

The Danish Health Data Network (Medcom) acts as a data integrator to ensure interoperability, although non-interoperability remains an issue despite the high adoption rate. The five regions are attempting to address this problem by each setting up their own electronic health record systems for public hospitals. However, all patient data will still be registered in the national e-journal.

Denmark's HealthIT/digital health sector is growing rapidly, with projections indicating that the Danish digital health market is poised to surpass USD 1 billion in value by 2025. Local enterprises are spearheading pioneering digital health solutions, which are being embraced by global patients and healthcare providers. The Danish government's supportive stance towards digital health is evident through well-crafted policies that foster an environment conducive to the development and promotion of digital health solutions by the private sector.

The COVID-19 pandemic accelerated the uptake of digital tools in Denmark's healthcare system, with telemedicine being used to deliver more patient-centred care, including treating more patients in primary care and at home, ultimately easing pressure on hospitals. Aspirations for the future include full digital integration of data across all levels of healthcare.

Strategies for Hospitals to Overcome Nursing Shortages

You may want to see also

Advertising through local and regional governments

Denmark has a mixed healthcare system with both public and private health institutions. Healthcare in Denmark is largely provided by the local governments of five regions, with coordination and regulation by the central government. These five regions are responsible for the operations of state-run medical facilities, hospitals, and health services provided by general practitioners and specialists. The central government provides block grants from tax revenues to these regions and municipalities, which deliver health services.

The Danish Health Authority oversees specialised hospital functions, unlike standard hospital services, which are run by the regions within the country. Each region determines the number and location of general practitioners, and their fees and working conditions are negotiated centrally between the physicians' union and the government. Citizens are assigned a specific general practitioner (GP) and may receive aid at no cost, including visiting a medical specialist at the referral of their GP.

The Danish Health Data Network (Medcom) acts as a data integrator to ensure interoperability. Each of the five regions uses electronic health record (EHR) systems for hospitals, with adherence to national standards for compatibility. All citizens in Denmark have a unique electronic personal identifier used in all public registries, including health databases. The government has implemented an electronic medical card that stores encoded information about each patient's prescriptions and medication use. This information is accessible by the patient and all relevant health professionals.

Denmark is building 16 new hospitals, including eight "super hospitals", with a budget of USD 7 billion. Investments in the best medical technology can be expected. The country is a frontrunner in medical device innovation, excelling in areas such as hearing aids, pacemakers, and surgical implants.

Switching VA Hospitals: A Step-by-Step Guide

You may want to see also

Advertising through healthcare accreditation

Denmark's healthcare system is decentralised, with the national government providing block grants from tax revenues to the five regions and municipalities that deliver health services. Healthcare in Denmark is largely provided by the local governments of these five regions, with coordination and regulation by the central government. Hospitals are mainly public and are owned and run by the regions.

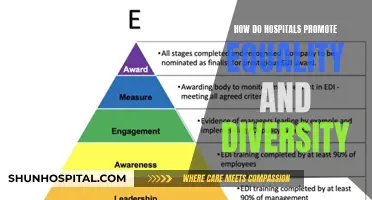

The Danish Institute for Quality and Accreditation in Healthcare (IKAS) was instrumental in implementing accreditation in hospitals and in primary and municipal health care through the Danish Healthcare Quality Program, which operated between 2004 and 2015. The program was phased out for hospitals and replaced by a new system in which regions are responsible for developing schemes that enable them to meet eight national quality targets and related indicators. Regional performance on the targets is monitored and published annually.

Accreditation for primary care is gradually being replaced by a system of collegial collaboration based on quality data. Accreditation is still available for municipal health services on a voluntary basis. The Danish Medicines Agency's laboratory is also accredited according to DS/EN ISO/IEC 17025. The accreditation is granted by DANAK (Danish Accreditation and Metrology Fund), meaning that the laboratory's analyses of medicines are conducted in compliance with established guidelines and that the laboratory is supervised by DANAK.

While I cannot find explicit information on how new hospitals advertise in Denmark, the country's commitment to progress and innovation in the healthcare sector is evident. Denmark has experienced a significant uptick in preventive care and health promotion, with increases in public expenditures on medical technology and digital health. As one of the most digital countries in the world, Denmark continues to advance innovative technologies and new ambitious digitalization strategies with a patient-centred approach. With a favourable regulatory environment and the government's supportive stance towards digital health, Denmark is well-positioned to attract investments and foster collaboration in the healthcare sector.

When it comes to advertising medical devices, Denmark has specific guidelines in place. The Executive Order no. 1155 of 22 October 2014, known as the Advertising Order, outlines that the advertisement and marketing of medical devices must be adequate, factual, and not mislead the end consumer. It also defines advertising broadly to include any form of door-to-door information, canvassing activity, or inducement designed to promote the prescription, supply, sale, or use of medical devices.

Streamlining Hospital Changes: A Comprehensive Guide

You may want to see also

Advertising through partnerships with insurance companies

Denmark's healthcare system is decentralised and universal, with the national government providing block grants from tax revenues to the regions and municipalities, which deliver health services. Healthcare in Denmark is largely provided by the local governments of five regions, with coordination and regulation by the central government. The public sector is the largest purchaser of healthcare products and services in Denmark.

Denmark's approach to public-private partnerships prioritises inclusivity, bringing together a diverse range of public and private stakeholders. Hospitals in Denmark are mainly public and are paid mainly through global budgets and case-based payments. Some bundled and value-based payment pilots exist at the local level.

Supplemental insurance, provided mainly by private employers, offers expanded access to private providers. Residents may purchase voluntary complementary insurance to cover copayments for outpatient drugs, dental care, and other services. This is because, despite healthcare being taxpayer-funded, personal expenses are still incurred and are usually associated with copayments for certain services. These expenses are usually covered by private health insurance.

Partnerships with insurance companies could be a viable advertising strategy for new hospitals in Denmark. Hospitals could partner with insurance providers to offer exclusive rates and packages to their customers. For example, a hospital could partner with an insurance company to offer discounted rates on specific procedures or treatments. This would incentivise people to sign up for the insurance company's plan, while also driving more patients to the hospital.

Another strategy could be for hospitals to collaborate with insurance companies on advertising campaigns. They could create joint advertisements that promote the benefits of their partnership, such as streamlined billing processes, reduced wait times, or access to specialised services. By working together, they can highlight the advantages of their collaboration and attract more customers.

Additionally, hospitals could also negotiate deals with insurance companies to become preferred providers. This means that the insurance company would direct their customers to the hospital, increasing patient volume and visibility for the hospital. In exchange, the hospital could offer discounted rates or other perks to the insurance company's customers.

Furthermore, hospitals could also offer insurance companies input on their policy offerings. By providing expertise and insights, hospitals can help insurance companies develop more attractive policies for their customers. This could include input on coverage limits, specific procedures or treatments to include, or ways to streamline the claims and reimbursement process.

Through these strategic partnerships with insurance companies, new hospitals in Denmark can effectively advertise their services, attract more patients, and establish themselves in the market.

Healthcare-Associated Infections: Hospitals' Costly Battle

You may want to see also

Frequently asked questions

Healthcare in Denmark is provided by the local governments of the five regions, with coordination and regulation by the central government. All residents are entitled to publicly financed care, including free primary, specialist, hospital, mental health, preventive, and long-term care services.

New hospitals in Denmark may advertise through word-of-mouth, as Danish citizens are generally satisfied with their public healthcare. Additionally, new hospitals can showcase their best medical technology, as Denmark is a frontrunner in medical device innovation. Furthermore, new hospitals can promote their use of telemedicine, which has been strengthened over the past decade.

The Danish government holds overall regulatory and supervisory responsibility, and expenditures amount to approximately 10.4% of the GDP. The government has also implemented an electronic medical card system, storing encoded information about each patient's prescriptions and medication use.

Denmark is one of the highest spenders in the OECD for spending on hospitals per capita, accounting for around 43% of total health expenditure, which is significantly above the 35% average in the OECD.