Medicare Part A covers inpatient hospital stays, including surgeries, bloodwork, diagnostics, and hospice care. However, patients are responsible for paying a portion of the costs, including deductibles, coinsurance, and copayments. The amount of coverage provided by Medicare depends on the length of the hospital stay, with coinsurance costs typically applying after 60 days. While Medicare provides coverage for up to 90 days of inpatient care, patients may need to use their 60 lifetime reserve days for longer stays, with higher copayment costs. Understanding Medicare coverage and potential out-of-pocket expenses is crucial when planning for hospital stays.

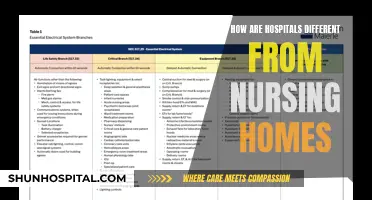

| Characteristics | Values |

|---|---|

| Medicare Part Covering Hospital Stays | Part A |

| Types of Facilities Covered | Acute care hospitals, critical access hospitals, long-term care hospitals, inpatient psychiatric facilities, inpatient rehabilitation facilities |

| Services Covered | Inpatient hospital care, surgeries, bloodwork, diagnostics, hospice care, limited skilled nursing facility, home health services, nursing home care, medications |

| Number of Days Covered | Up to 90 days with coinsurance costs; 60 lifetime reserve days beyond with higher copayment costs |

| Costs Covered by Medicare | Remainder of hospital care costs after deductible is met for up to 60 days; 60 lifetime reserve days with higher copayment costs |

| Costs Covered by Patients | Deductible, coinsurance, copayments, out-of-pocket costs for extended stays |

| Cost-Sharing for Doctors' Services | Medicare Part B covers up to 80% of Medicare-approved amounts |

| Supplemental Insurance | Medigap covers some of the coinsurance and copay costs |

What You'll Learn

Medicare Part A covers inpatient hospital stays

Medicare Part A, also known as hospital insurance, covers inpatient hospital stays. It typically covers inpatient surgeries, bloodwork, diagnostics, and hospital stays. However, patients are responsible for paying a portion of the costs, including a deductible and coinsurance. The deductible for Medicare Part A in 2025 is $1,676 per benefit period, and patients are responsible for paying a daily coinsurance of $419 for days 61 to 90 of their stay.

Medicare Part A also provides coverage for inpatient care in critical access hospitals and skilled nursing facilities. This includes room and board, as well as administering medicine or changing sterile dressings. To qualify for coverage in a skilled nursing facility, patients must spend at least three days as inpatients in a hospital within 30 days of being admitted to the skilled nursing facility.

Medicare Part A also covers hospice care and limited skilled nursing facility and home health services. Hospice care provides comfort to patients who are terminally ill, and Medicare will cover the cost as long as the patient's provider certifies the care. Medicare Part A can also cover up to 100 days of home healthcare if the patient spent at least three days as a hospital inpatient within 14 days of receiving home healthcare.

It is important to note that Medicare Part A does not cover the costs of long-term stays at skilled nursing facilities. Additionally, Part A only pays for up to 190 days of inpatient mental health care in a freestanding psychiatric hospital during an individual's lifetime. This limit does not apply to care received in a Medicare-certified psychiatric unit within an acute care or critical access hospital.

Volunteering at a Hospital: Steps to Take

You may want to see also

Patients are responsible for a portion of costs

Medicare Part A covers inpatient hospital care, including surgeries, bloodwork, diagnostics, and hospice care. However, patients are responsible for paying a portion of the costs. These out-of-pocket expenses include deductibles, coinsurance, and copayments. In 2025, the deductible for Medicare Part A is $1,676 per benefit period, which covers the days of inpatient care and 60 consecutive days after discharge. If a patient is readmitted within 60 days of discharge, they do not need to pay another deductible.

Coinsurance costs apply after the initial 60 days of hospitalisation. From days 61 to 90, patients are responsible for a daily coinsurance payment of $419 in 2025. After day 90, the costs increase further, with patients paying $838 per day for each "lifetime reserve day" after day 90. Everyone is granted up to 60 lifetime reserve days over their lifetime. These days provide additional coverage beyond the initial 90 days of inpatient care.

Once the 60 lifetime reserve days are exhausted, patients become responsible for paying all additional hospital costs out-of-pocket. The high costs associated with lengthy hospital stays can be mitigated by purchasing supplemental insurance, such as Medigap, which covers some of the coinsurance and copay costs. Therefore, while Medicare Part A provides valuable coverage for inpatient hospital stays, patients should be aware that they will still need to contribute a portion of the costs, and supplemental insurance may be beneficial for extended stays.

Venezuela's Healthcare Crisis: Power Loss in Hospitals

You may want to see also

Lifetime reserve days provide coverage after 90 days

Lifetime reserve days are an important feature of Medicare, providing coverage for individuals who require extended hospital stays. After the initial 90 days of covered inpatient care, Medicare offers 60 lifetime reserve days to help with the costs of prolonged hospitalisation. These reserve days can be used to cover the copayment costs, which are significantly higher during this period. For instance, in 2025, the copayment cost for each lifetime reserve day was $838.

It is important to note that lifetime reserve days can be used at the individual's discretion. They don't have to be utilised all at once during a single hospital stay. For instance, if an individual has two extended hospital stays, each amounting to 120 days, they can use 30 lifetime reserve days for each period. This flexibility ensures that individuals can manage their coverage according to their specific needs.

The activation of lifetime reserve days occurs after the initial 90 days of covered inpatient care. During these initial 90 days, Medicare Part A covers various inpatient services, including surgeries, bloodwork, diagnostics, and hospital stays. However, it's important to understand that even with Medicare, individuals are typically responsible for paying a portion of the hospital bill, including deductibles and coinsurance.

While Medicare Part A provides coverage for inpatient hospital care, it's not unlimited. The 60 lifetime reserve days offered by Medicare serve as a crucial buffer to help individuals manage the financial burden of extended hospital stays. After these reserve days are exhausted, individuals will be responsible for covering all costs associated with their hospital stay out of their own pocket. Therefore, it is advisable for individuals anticipating lengthy hospital stays to consider supplemental insurance options to offset potential out-of-pocket expenses.

In conclusion, lifetime reserve days offered by Medicare provide valuable coverage for individuals who require hospital stays exceeding 90 days. These reserve days help manage the financial burden of extended care, giving individuals peace of mind during challenging times. However, it is essential to plan and explore additional insurance options to ensure comprehensive coverage in case of prolonged or unexpected hospitalisations.

Sexual Assault in Hospitals: A Common Occurrence?

You may want to see also

Medicare Part B covers doctor services during hospital stays

Medicare Part A is the component of Original Medicare that covers inpatient hospital stays. It covers inpatient hospital care, including surgeries, bloodwork, diagnostics, and hospital stays. However, patients are responsible for paying a portion of the costs, including a deductible and coinsurance.

Medicare Part B, on the other hand, covers doctor services during hospital stays. If you have Medicare Part B, it generally covers 80% of the Medicare-approved amount for doctors' services received during a hospital stay. It is important to note that you may still be responsible for paying a portion of the hospital bill, depending on the specific services received and the recommendations of your doctor or healthcare provider.

The length of your hospital stay also affects the coverage provided by Medicare. Medicare Part A covers up to 90 days of inpatient hospital care, with daily copayments required after the first 60 days. If you require a longer stay, you can utilize your 60 lifetime reserve days, which provide additional coverage with higher copayment costs. After exhausting the lifetime reserve days, you will be responsible for all costs associated with the hospital stay.

It is worth noting that Medicare Part A also covers hospice care, skilled nursing facility care, and home health services, but there may be out-of-pocket costs and limitations on the duration of coverage. Therefore, it is essential to review your insurance coverage and understand your specific plan's premiums, coverage limits, and potential out-of-pocket expenses.

Nurses' Battle: Hospital-Acquired Infections' Impact

You may want to see also

Supplemental insurance can offset costs of lengthier stays

While Medicare Part A covers inpatient hospital stays, patients are responsible for paying a portion of the costs, including deductibles, copayments, and coinsurance. For instance, in 2025, there is a deductible of $1,676 per benefit period, plus daily copayments of $419 for days 61 to 90 of a hospital stay. After 90 days of covered inpatient care, Medicare provides 60 lifetime reserve days with a higher copayment cost of $838 per day. After using up these reserve days, individuals will have to pay all costs associated with their hospital stay.

To offset these costs, you can purchase supplemental insurance, also known as Medigap, which covers some of the coinsurance and copay costs. Another option is hospital indemnity insurance, which supplements your existing health insurance coverage by helping to pay for expenses incurred during hospital stays. Depending on the plan, hospital indemnity insurance provides cash payments to cover extra expenses accrued during recovery, such as childcare expenses or cost-of-living expenses. These plans are typically lower in cost and can provide financial peace of mind in the event of an unexpected hospital stay.

Medicare Part B, which covers 80% of the Medicare-approved amount for doctors' services received during a hospital stay, can also help offset the costs of lengthier stays. However, it's important to note that Medicare Part B is separate from Medicare Part A and may not be included in your coverage.

In summary, while Medicare Part A provides coverage for inpatient hospital stays, it's important to be aware of the out-of-pocket expenses that can accumulate during lengthier stays. Supplemental insurance, such as Medigap or hospital indemnity plans, can help offset these costs and provide financial protection during unexpected hospitalizations. Additionally, Medicare Part B may also contribute to reducing the financial burden of extended hospital stays.

Antibiotic Resistance: Hospitals' Growing Concern

You may want to see also

Frequently asked questions

Medicare Part A covers inpatient hospital care, including surgeries, bloodwork, diagnostics, and hospital stays. It also covers hospice care and limited skilled nursing facility and home health services.

Medicare Part A covers 90 days of inpatient hospital stays. After 60 days, you'll have to pay coinsurance, and the amount increases based on the length of your stay. In 2025, the daily coinsurance for days 61 to 90 is $419. After day 90, you can use your 60 lifetime reserve days, where you pay a higher copayment cost of $838 per day.

Yes, there are some limitations to Medicare Part A coverage for hospital stays. You will be responsible for paying a portion of the costs, including a deductible and coinsurance. In 2025, the Medicare Part A deductible is $1,676 per benefit period. Additionally, Medicare Part A does not cover the costs of long-term stays at skilled nursing facilities.

Yes, you may consider buying supplemental insurance, such as Medigap, to help offset the costs of lengthy hospital stays. Medicare Part B may also cover up to 80% of the Medicare-approved amounts for doctor's services while you are in the hospital.