Medicare is a health insurance program that provides coverage for a range of services, including inpatient hospital care. The costs associated with Medicare can vary based on factors such as income, the type of services received, and the providers visited. It's important for individuals to understand their Medicare plan, including any deductibles, to ensure they find a suitable plan that fits their needs and budget. Medicare deductibles refer to the amount one must pay for covered health care services before their Medicare plan starts contributing. The deductibles for Medicare Part A, Part B, and Part D differ and are subject to change annually.

| Characteristics | Values |

|---|---|

| Medicare deductible | Annual amount paid for covered health care services before your Medicare plan starts to pay |

| Average Medicare Advantage/Part C premiums for 2025 | $0 to $240+ |

| Medicare Part D deductible | $590 per year |

| Medicare Part B deductible | $257 in 2025 |

| Medicare Part A inpatient hospital deductible | $1,676 in 2025 |

| Medicare Part B premium | $185 in 2025 |

What You'll Learn

Medicare Part A deductible

Medicare Part A covers inpatient hospital stays and some follow-up care. The deductible is the annual amount you pay for covered services before your insurance starts to pay. The 2025 Medicare Part A deductible for inpatient hospital stays is $1,676, an increase of $44 from the 2024 deductible of $1,632. This amount covers the beneficiary's share of costs for the first 60 days of a Medicare-covered hospital stay in a benefit period.

It's important to note that the Part A deductible is not an annual deductible; it applies to each benefit period. A benefit period begins when you are admitted to the hospital and ends once you have been out of the hospital or a skilled nursing facility for 60 consecutive days. This means that if you have multiple hospital stays within a year, you may need to pay the Part A deductible multiple times.

Once you've paid the Part A deductible, you will typically only need to pay a copayment or coinsurance for each day of your stay, and Medicare will cover the rest. The coinsurance amount for 2025 is $419 per day for the 61st through 90th day of hospitalization, and $838 per day for lifetime reserve days. For beneficiaries in skilled nursing facilities, the daily coinsurance for days 21 through 100 of extended care services is $209.50 in 2025.

It's worth considering supplemental coverage, like a Medicare Supplement Insurance (Medigap) policy or a Medicare Advantage Plan, as these can help with out-of-pocket costs and provide additional benefits. The costs associated with Medicare can vary based on factors such as income, location, and the specific plan chosen.

UNC Chapel Hill Hospital: Size and Scope Explored

You may want to see also

Medicare Part B deductible

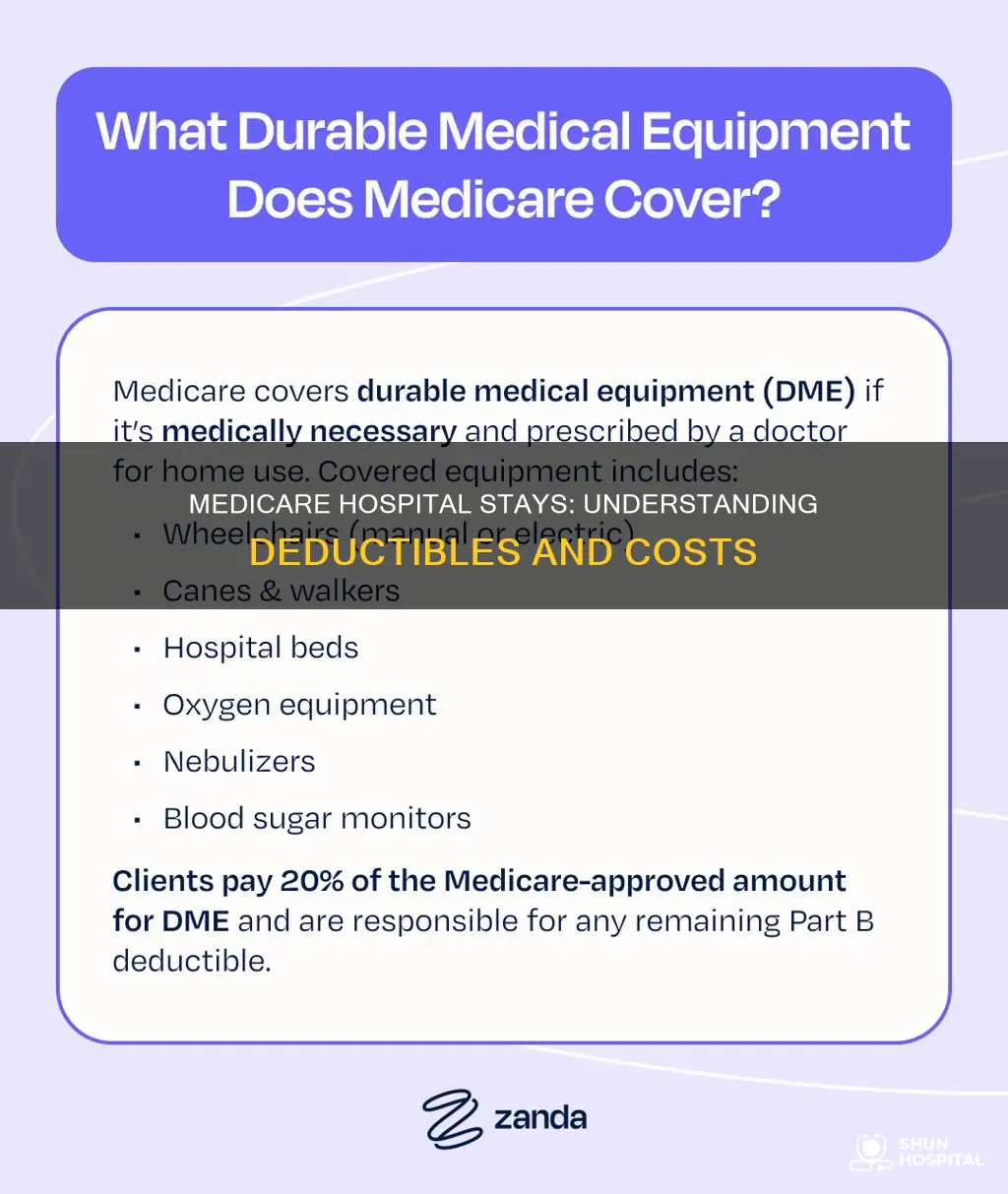

Medicare Part B covers physicians' services, outpatient hospital services, certain home health services, durable medical equipment, and certain other medical and health services not covered by Medicare Part A. The standard monthly premium for Medicare Part B enrollees will be $185.00 for 2025, an increase of $10.30 from $174.70 in 2024. The annual deductible for all Medicare Part B beneficiaries will be $257 in 2025, a rise of $17 from the $240 annual deductible in 2024.

The Medicare deductible is the annual amount you pay for covered health care services before your Medicare plan starts to pay. Once you've satisfied your deductible, you'll typically only pay a copayment or coinsurance, and Medicare pays the rest. Deductibles, coinsurance, and copayments vary based on which plan you join. Plans also have a yearly limit on what you pay out-of-pocket. Once you pay the plan's limit, the plan pays 100% for covered health services for the rest of the year.

Medicare Part B also includes medically necessary services and supplies that meet accepted standards of medical practice to diagnose or treat a medical condition. Preventive services are also covered, such as healthcare to prevent illness (like the flu) or detect it at an early stage when treatment is most likely to be successful. Most preventive services are free if you get them from a healthcare provider who accepts assignments.

If you're enrolled in a Medicare Advantage Plan or another Medicare plan, your plan may have different rules. However, your plan must give you at least the same coverage as Original Medicare. For instance, if you use an insulin pump covered under Part B's durable medical equipment benefit, or you get your covered insulin through a Medicare Advantage Plan, your cost for a month's supply of Part B-covered insulin for your pump cannot exceed $35.

Profit-Seeking Hospitals: Making Money, Saving Lives?

You may want to see also

Medicare Supplement Insurance

Medicare is a health insurance program that helps cover the cost of healthcare services for eligible individuals. While Medicare provides valuable coverage, it doesn't cover all healthcare expenses, and beneficiaries are typically responsible for certain out-of-pocket costs. This is where Medicare Supplement Insurance, also known as Medigap, comes in.

To be eligible for a Medigap policy, individuals must already have Original Medicare, which consists of Part A (Hospital Insurance) and Part B (Medical Insurance). Medigap policies are designed to supplement this coverage by helping to pay for deductibles, copayments, and coinsurance. For example, most Medigap plans cover the Medicare Part A hospital deductible, which in 2025, is projected to be $1,676 for a covered hospital stay.

It's important to note that Medigap policies have different monthly premiums, and the benefits and costs can vary depending on the plan chosen. Some plans have higher monthly premiums but cover more out-of-pocket costs, while others have lower premiums and cover fewer costs. Additionally, some Medigap policies include extra benefits, such as coverage for healthcare expenses incurred while travelling outside the country.

When considering Medicare Supplement Insurance, it's essential to carefully review the available plans and choose one that best suits your needs and budget. Organizations like AARP offer endorsed Medigap plans, providing additional options for individuals seeking to supplement their Original Medicare coverage.

South Korea's Hospitals: World-Class Healthcare

You may want to see also

Medicare Advantage plans

The costs of Medicare Advantage plans vary. In 2025, the average monthly premiums are projected to range between $0 and $240+, with the estimated average plan costing $17 per month. Some Medicare Advantage plans have no deductible, but these plans may cost more in monthly premiums. If you have a $0 premium plan, you will still have to pay a fixed co-payment for doctor's visits, which is usually less than the 20% coinsurance you would pay with Part B.

It is important to note that the costs of Medicare Advantage plans may change each year and depend on which policy you buy, where you live, and other factors.

Managing Blood Sugar: When to Go to the Hospital

You may want to see also

Medicare Part D deductible

Medicare Part D offers prescription drug coverage. The deductible is the amount you pay each year before your Medicare begins to pay. In 2025, the highest deductible that a stand-alone prescription drug plan can charge is $590. However, some drug plans charge a $0 yearly deductible, while others may offer a deductible lower than the maximum, such as $150 or $250. The deductible varies depending on the insurer, your location, and other factors.

After you meet your deductible, your plan will begin to cover the cost of your drugs. During the initial coverage stage, you'll pay 25% of the cost as coinsurance for your generic and brand-name drugs until your out-of-pocket spending on covered Part D drugs reaches $2,000 in 2025. At this point, you'll automatically get "catastrophic coverage," where you won't have to pay out-of-pocket for covered Part D drugs for the rest of the calendar year.

It's important to note that your deductible isn't your only out-of-pocket cost. When you enrol in a Part D plan, you're also responsible for paying premiums, copayments, and coinsurance amounts. The premium is the monthly amount you pay to enrol in your prescription drug plan, and it can vary depending on factors such as your income. If you have a higher income, you may need to pay an income-related monthly adjustment amount (IRMAA).

Additionally, there is a Part D late enrollment penalty if you don't enrol in a Medicare drug plan when you first become eligible. This penalty is calculated by multiplying 1% of the "national base beneficiary premium" by the number of full months you were eligible but didn't enrol. This amount is added to your monthly premium and may increase each year.

To help with prescription drug costs, Medicare offers the Extra Help program, which assists with paying premiums, deductibles, copayments, and coinsurance costs. To qualify, your resources, including cash, savings, and investments, must not exceed a certain total amount.

Hospital Stay Length: Impact on Patient Recovery and Complications

You may want to see also

Frequently asked questions

Yes, Medicare has a deductible for hospital stays. The deductible amount varies depending on the type of Medicare plan and the services covered. For example, the Medicare Part A inpatient hospital deductible was $1,676 in 2025.

A Medicare deductible is the annual amount you pay for covered healthcare services before your Medicare plan starts to pay. Once you've met your deductible, you typically only pay a copayment or coinsurance, with Medicare covering the rest.

The annual deductible for Medicare Part B was $257 in 2025. This amount changes annually and is determined according to provisions of the Social Security Act.

Yes, there are a few options to help reduce the cost of Medicare deductibles for Part A and Part B. One option is to purchase Medical Supplement Insurance, also known as Medigap, which can help cover some of the costs associated with Original Medicare, including deductibles. Another option is to enroll in Medicare Advantage, which offers additional coverage on top of Original Medicare. Low-income Medicare recipients may also be eligible for the Extra Help program, which assists with the cost of prescription drugs and related expenses.